Pure Tax Investigations

Pure Tax Investigations provides expert defense for businesses facing complex HMRC tax disputes and investigations.

Visit

About Pure Tax Investigations

Pure Tax Investigations is a specialist advisory firm that acts as an independent, expert buffer between clients and HM Revenue & Customs (HMRC). The firm provides robust defence and strategic resolution for businesses, entrepreneurs, and private clients facing HMRC scrutiny. Its core value proposition lies in offering bespoke, pragmatic, and discreet representation during some of the most stressful and complex tax disputes an individual or company can face. Led by Amit Puri, a former senior HMRC Tax Inspector with over 20 years of experience, the team leverages insider knowledge of HMRC's operational approaches to secure commercial outcomes. Pure Tax Investigations specialises in serious civil investigations like Code of Practice 9 (COP9) for suspected fraud and Code of Practice 8 (COP8) for complex avoidance, as well as managing comprehensive compliance checks and facilitating voluntary disclosures through campaigns like the Worldwide Disclosure Facility (WDF) and Let Property Campaign (LPC). The firm's mission is to alleviate client pressure, provide certainty, and preserve wealth through tailored analysis and tenacious advocacy.

Features of Pure Tax Investigations

Specialist Ex-HMRC Leadership

The firm is led by Amit Puri, a former senior HMRC Tax Inspector. This provides clients with an invaluable strategic advantage, as the team operates with a deep, insider understanding of HMRC's methodologies, priorities, and negotiation tactics, ensuring advice is both credible and highly effective.

End-to-End Investigation Management

Pure Tax Investigations manages the entire lifecycle of a tax dispute. From the initial HMRC contact letter through to negotiation and final settlement, they handle all communications, evidence preparation, and technical arguments, serving as the sole point of contact to shield clients from direct HMRC pressure.

Bespoke Disclosure Facilitation

The firm expertly navigates HMRC's voluntary disclosure facilities, such as the Worldwide Disclosure Facility (WDF) and Let Property Campaign (LPC). They provide a structured, compliant pathway for clients to regularise their tax affairs, often mitigating potential penalties and avoiding more serious investigation procedures.

Multi-Tier Case Defence

Their services are scalable, covering everything from routine compliance checks to the most serious fraud investigations (COP9) and complex enquiries into large corporates. This ensures clients receive appropriately resourced and specialised support regardless of the investigation's scale or complexity.

Use Cases of Pure Tax Investigations

Defence Against COP9 (Fraud Investigation)

When a client receives a Code of Practice 9 (COP9) letter, indicating HMRC suspects serious tax fraud, Pure Tax Investigations steps in to manage the Contractual Disclosure Facility (CDF) process. They guide the client through the meticulous disclosure required to seek a civil settlement and avoid criminal prosecution.

Responding to COP8 (Complex Avoidance)

For clients facing a Code of Practice 8 (COP8) investigation into complex tax avoidance arrangements, the firm analyses the technical merits of HMRC's challenge. They build a robust defence or negotiate a settlement, protecting the client's position in highly technical and protracted disputes.

Managing Large Corporate Compliance Checks

When HMRC launches a comprehensive, cross-taxes enquiry into a large business or corporate group, Pure Tax Investigations provides the specialist resource to manage the process. They coordinate responses, handle information requests, and defend the company's tax computations at a senior level.

Voluntary Disclosure for Unreported Income

Clients with undisclosed income, such as offshore assets, rental profits from property, or cryptocurrency gains, engage the firm to make a voluntary disclosure under an HMRC campaign (e.g., WDF or LPC). This proactive approach regularises their affairs and limits financial exposure to taxes, interest, and penalties.

Frequently Asked Questions

Is a COP9 tax fraud investigation serious?

Yes, a Code of Practice 9 (COP9) investigation is extremely serious. It is undertaken by HMRC's Fraud Investigation Service when they suspect serious tax fraud from the outset. The process is designed to secure a financial recovery (tax, interest, and penalties) on a civil basis, offering the taxpayer an opportunity to avoid criminal prosecution through full disclosure under the Contractual Disclosure Facility (CDF).

What is the difference between a routine enquiry and a tax investigation?

A routine HMRC enquiry or compliance check typically focuses on clarifying specific aspects of a tax return. A full tax investigation, such as under COP8 or COP9, is far more in-depth and intrusive. It involves a comprehensive examination of a taxpayer's affairs, often across multiple tax years and different taxes, based on a suspicion of significant error, avoidance, or fraud.

What are the benefits of using a specialist firm over my general accountant?

Tax investigations require specific expertise in HMRC's specialist investigation procedures, negotiation tactics, and disclosure protocols. A dedicated firm like Pure Tax Investigations operates with this focused experience daily, including ex-HMRC insight, providing a robust defence strategy that a general practice accountant may not have the depth or resources to offer effectively.

What happens during a Let Property Campaign (LPC) disclosure?

The Let Property Campaign is a voluntary disclosure facility for landlords with undisclosed rental income. With Pure Tax Investigations, a client will work to calculate the undisclosed income and gains, prepare the necessary disclosure forms, and negotiate with HMRC to settle the owed tax, interest, and mitigated penalties, thereby bringing their affairs up to date.

You may also like:

Moon Banking

The largest global bank dataset with AI-native integrations (MCP, OpenClaw, API). For analysts, marketers, developers, institutions.

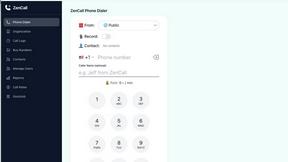

ZenCall

Browser-based international calling with transparent pay-as-you-go pricing. No apps, no subscriptions—just affordable global calls.

ExpenseManager

All-in-one app to track expenses, split bills, scan receipts, and forecast cash flow — for individuals, couples, and groups.