Private Equity List

Unlock funding effortlessly with our AI-powered Private Equity List, providing curated data on investors and accelera...

Visit

About Private Equity List

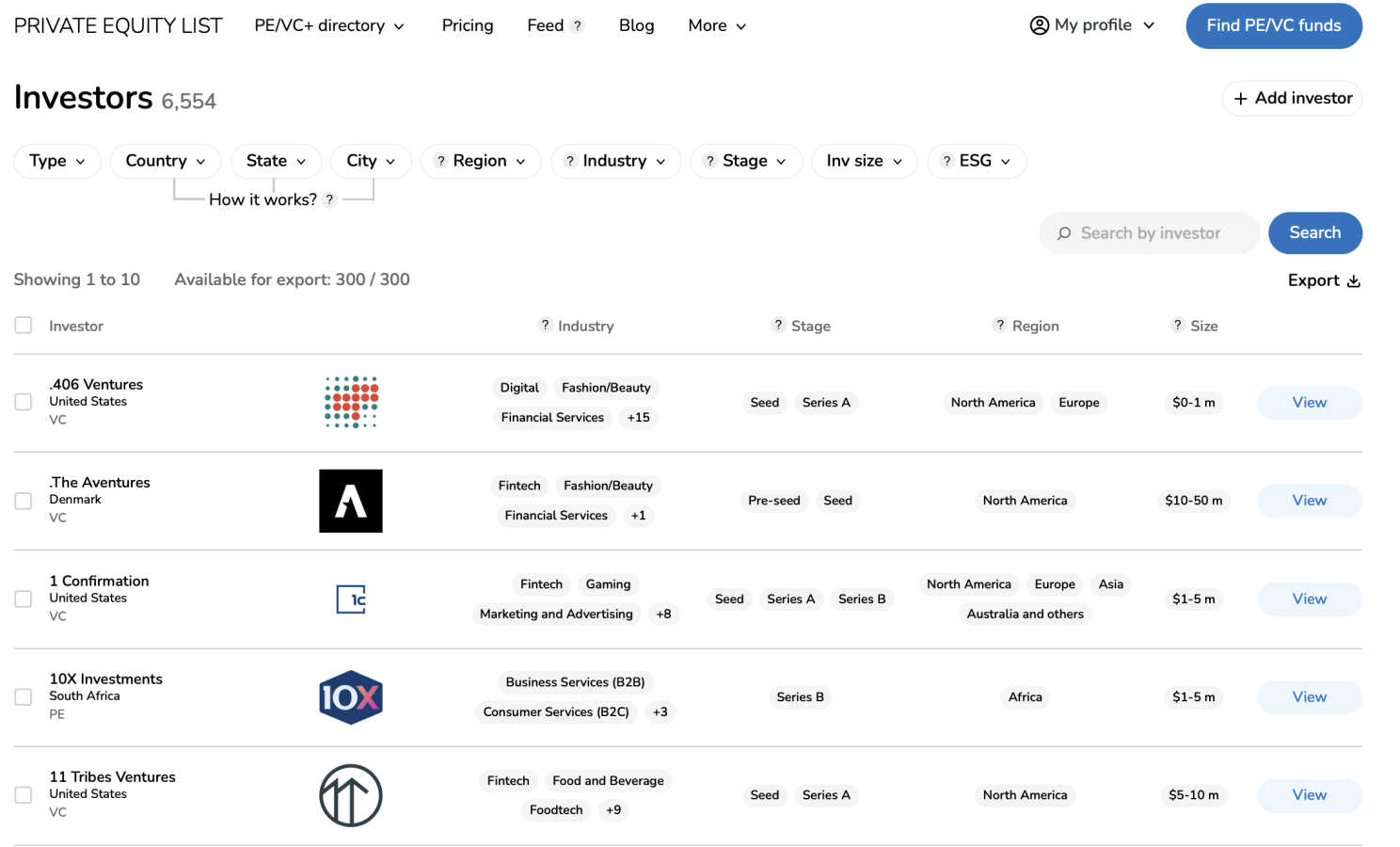

PrivateEquityList.com is an advanced database designed specifically for private equity firms and venture capital funds. Its unique selling proposition lies in its user-friendly interface, which allows users to conduct efficient and targeted searches through a plethora of filters. This platform provides a comprehensive repository of data, making it an invaluable resource for startups, consultants, venture capitalists, universities, and business owners. With over 10,300 users leveraging this platform for fundraising, partnerships, and research, Private Equity List has proven itself as the best value alternative to more expensive solutions like Pitchbook and Crunchbase. Recently, the platform has undergone significant updates, including the introduction of an AI-powered search function, enhancing its usability and effectiveness.

Features of Private Equity List

AI-Powered Search Function

The newly integrated AI search capability allows users to quickly and accurately find relevant PE/VC investors. This feature streamlines the data retrieval process, making it easier to discover potential funding opportunities tailored to specific project needs.

Intuitive Search Filters

Private Equity List offers a robust set of filters that enable users to narrow down their search by various parameters such as geographical location, investment stage, and investment thesis. This functionality ensures that users can efficiently find the most suitable investors based on their specific criteria.

Comprehensive Investor Data

The platform provides extensive data on over 7,000 PE/VC investors and more than 27,000 contacts from investment teams globally. This extensive database is continually updated to ensure users have access to the most recent information and opportunities in the market.

Export-Ready Lists

Users can easily generate and export structured lists of PE/VC investors and their contact details at an affordable rate. This feature is designed for efficiency, allowing users to create tailored reports and contact lists without facing the prohibitive costs often associated with such comprehensive data.

Use Cases of Private Equity List

Fundraising for Startups

Startups seeking funding can utilize Private Equity List to quickly identify and connect with relevant investors, ranging from pre-seed to Series C. The ability to filter by geographic location and investment thesis accelerates the fundraising process, giving startups a competitive edge.

Consultant and Advisor Support

Consultants and advisors can leverage the platform to create customized investor shortlists for their clients, streamlining the fundraising and M&A processes. By accessing targeted investor data, they can enhance their service offerings and achieve faster success fees.

VC Ecosystem Collaboration

Funds, accelerators, and venture studios can use Private Equity List to discover co-investors and strategic partners across thousands of funds. This collaborative feature helps enhance portfolio companies’ next funding rounds while fostering a vibrant ecosystem.

Research and Reporting

Universities, researchers, and journalists can tap into the intelligence provided by Private Equity List for research and reporting purposes. By accessing curated data, they can produce insightful analyses and reports on industry trends, investor behaviors, and market dynamics.

Frequently Asked Questions

What types of users benefit from Private Equity List?

Private Equity List caters to a diverse range of users including startups, consultants, venture capitalists, universities, and business owners who require accurate data on private equity and venture capital firms.

How does the AI search function work?

The AI search function analyzes users' queries and retrieves the most relevant PE/VC investors based on the provided criteria. However, it is important to verify the accuracy of the results as the AI may occasionally make mistakes.

Can I export the data I find on the platform?

Yes, users can export structured lists of PE/VC investors and their contact information in a user-friendly format. This feature is designed to facilitate easy sharing and utilization of data for various purposes.

Is there a free trial available for new users?

Absolutely! Private Equity List offers basic functions for free, allowing users to explore the platform without requiring a credit card. This enables potential users to assess its value before committing to a subscription.

You may also like:

Moon Banking

The largest global bank dataset with AI-native integrations (MCP, OpenClaw, API). For analysts, marketers, developers, institutions.

ZenCall

Browser-based international calling with transparent pay-as-you-go pricing. No apps, no subscriptions—just affordable global calls.

ExpenseManager

All-in-one app to track expenses, split bills, scan receipts, and forecast cash flow — for individuals, couples, and groups.