Poach

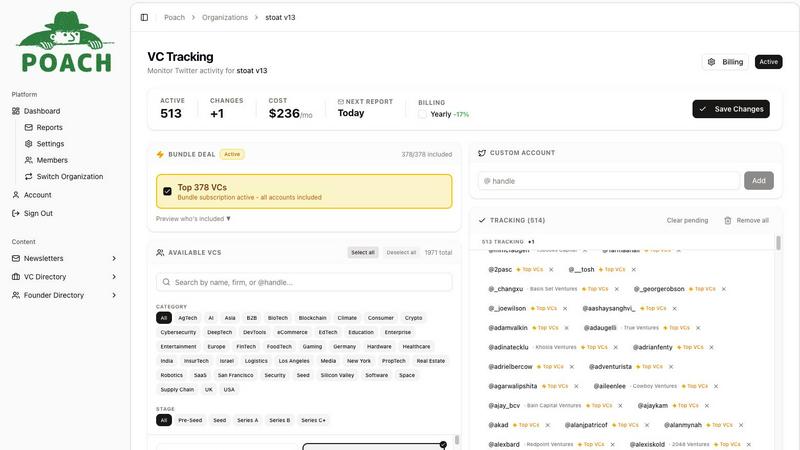

Poach helps venture capitalists discover promising founders early by tracking competitor VC activity.

Visit

About Poach

Poach is a sophisticated dealflow intelligence platform designed for venture capital investors, angel investors, and other capital allocators. It operates on a powerful premise: the earliest signal of a promising startup often appears not in a pitch deck, but in the social media activity of top-tier VCs. Poach systematically tracks which individuals venture capitalists follow on platforms like Twitter (X), interpreting these follows as early indicators of interest in promising founders, often months before a formal fundraising process begins. This provides a high-quality signal that sits strategically between a warm introduction and cold inbound outreach, offering a significant competitive edge. The platform then enriches this raw social data with professional information from LinkedIn and employs AI-powered analysis to categorize and label individuals (e.g., as unfunded founders, engineers, researchers). The final output is delivered as actionable, enriched CSV exports directly to the user's inbox, enabling investors to identify and engage with high-potential talent at the earliest possible stage, effectively allowing them to "poach" deals from the stealth phase.

Features of Poach

VC Social Tracking & Signal Detection

Poach's core engine continuously monitors the Twitter followings of a curated list of top-tier venture capitalists. This is based on the proven hypothesis that VCs often follow founders they are researching, advising, or considering for investment long before any public announcement. By aggregating and analyzing these follows, Poach transforms passive social data into a proactive, high-conviction signal for expanding dealflow, providing a window into the private market movements of leading investors.

Proprietary LinkedIn Enrichment & Identity Resolution

To transform a Twitter handle into a qualified lead, Poach employs advanced identity resolution technology to accurately match social profiles with corresponding LinkedIn accounts. This process enriches each record with critical professional data, including detailed work history, educational background, and career trajectory. This step is crucial for validating a person's professional standing and understanding their potential role in a startup ecosystem.

AI-Powered Professional Labeling & Bio Generation

Using the combined data from Twitter and LinkedIn, Poach's AI algorithms automatically label each individual with specific, actionable tags. These labels include "founder," "funded," "engineering," "product," "research," and "investor," among others. The AI also synthesizes a concise, informative biography for each person. This automated categorization allows users to instantly filter and segment leads based on their specific investment thesis, such as finding "unfunded founders" or "researchers turning entrepreneur."

Raw Data Delivery & Daily Executive Summaries

Poach delivers insights in a practical, analyst-friendly format. Subscribers receive a daily email digest containing an executive summary of new leads. Attached to each email is a comprehensive CSV file with all enriched data, including Twitter handles, LinkedIn URLs, AI-generated labels, bios, and which VC provided the signal. This raw data export empowers investment teams to integrate leads directly into their CRM, perform custom analysis, and prioritize outreach based on their own internal criteria.

Use Cases of Poach

Identifying Stealth-Mode Founders Pre-Round

The primary use case for Poach is enabling early-stage VCs and angels to discover founders who are building companies in stealth, often before they have even begun a formal seed round. By filtering the CSV data for profiles labeled "founder" but not "funded," investors can build a targeted list of promising individuals to engage with at the ideation or prototype stage, securing a position as the first institutional money in.

Sourcing Non-Traditional Technical Talent

Investment firms with a thesis around deep tech or AI can use Poach to identify individuals with "research" or specific "engineering" labels from elite academic or corporate backgrounds (e.g., Caltech PhDs, ex-Google DeepMind staff) who are showing early signals of entrepreneurial activity via VC follows, indicating a potential transition from researcher to founder.

Competitive Intelligence & Market Mapping

Investors can use Poach to monitor which specific individuals or skill sets (e.g., "web3," "product") are attracting attention from competing VC firms. Tracking which profiles are followed by multiple respected investors can serve as a powerful validation signal and help map emerging trends and talent movements within specific sectors before they become widely known.

Enhancing Outbound Sourcing Campaigns

Instead of relying on generic cold outreach, investment associates and sourcers can use Poach's enriched CSV files to build highly personalized outbound sequences. The provided LinkedIn URL, work history, AI-generated bio, and context of which VC followed them allow for tailored, informed communication that references a shared connection or specific professional achievement, dramatically increasing response rates.

Frequently Asked Questions

How accurate is Poach's data and labeling?

Poach utilizes a multi-step verification process to ensure high accuracy. Its proprietary identity resolution aims for precise Twitter-to-LinkedIn matching. The AI labeling is trained on vast datasets of professional profiles and bios, though it is always recommended that users perform their own due diligence. The platform's proven track record of identifying founders like Eli Badgio 7 months before their raise demonstrates the signal's reliability.

What is the source of Poach's VC "follow" data?

Poach monitors the public Twitter followings of a vetted directory of top-tier venture capital partners and firms. The follows are public data points; Poach's innovation lies in systematically collecting, aggregating, and analyzing this data to extract meaningful investment signals, turning observable social behavior into a structured intelligence feed.

Can I filter for very specific types of founders or talent?

Yes, this is a core strength of the platform. The daily CSV export includes all AI-generated labels (e.g., founder, funded, engineering, research). Users can filter this raw data using spreadsheet software or their CRM based on any combination of labels, location, bio keywords, or the specific VC who followed them to find talent that matches a highly specific investment thesis.

How is Poach different from other startup databases or scouting services?

Unlike static databases that list already-funded companies or scouting services that rely on self-submissions, Poach provides a predictive, signal-based approach. It detects interest at the individual and pre-company stage by analyzing the behavior of expert investors (VCs). It offers raw data for your own analysis rather than just curated lists, giving you control and a unique, early-mover advantage in deal sourcing.

You may also like:

Moon Banking

The largest global bank dataset with AI-native integrations (MCP, OpenClaw, API). For analysts, marketers, developers, institutions.

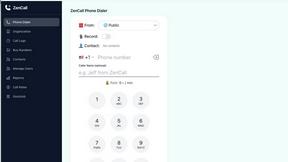

ZenCall

Browser-based international calling with transparent pay-as-you-go pricing. No apps, no subscriptions—just affordable global calls.

ExpenseManager

All-in-one app to track expenses, split bills, scan receipts, and forecast cash flow — for individuals, couples, and groups.