Ambriel

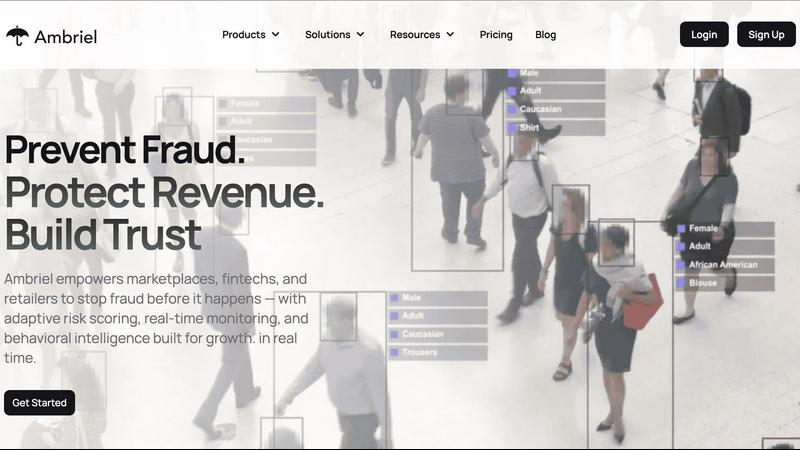

Ambriel is an AI-powered risk engine that detects and prevents fraud in real time to protect revenue.

Visit

About Ambriel

Ambriel is an advanced, integrated fraud intelligence and risk management platform engineered for the digital economy. It is specifically designed to help fintech companies, online marketplaces, retailers, and iGaming platforms operate securely, maintain regulatory compliance, and protect their user base, all while preserving a seamless experience for legitimate customers. The platform's core value proposition lies in its ability to proactively detect, score, and prevent sophisticated fraud before it can impact revenue or damage hard-earned reputation. By consolidating behavioral analytics, device fingerprinting, global sanctions screening, and real-time risk scoring into a single, powerful ecosystem, Ambriel provides a holistic defense. It analyzes a multitude of signals—from transaction details and user behavior patterns to device attributes and network data—to uncover hidden risk patterns and automate mitigation responses. This comprehensive approach is critical in an era where, according to industry reports, fraud attempts against digital businesses continue to grow in both volume and sophistication, necessitating layered, intelligent defense systems.

Features of Ambriel

AI-Driven Risk Scoring Engine

At the heart of Ambriel is a sophisticated risk-scoring engine powered by artificial intelligence and machine learning. It analyzes data from over 200 unique sources, including user behavior, device intelligence, and transaction history, to generate a real-time risk score for every user interaction. This allows businesses to make instantaneous, data-backed decisions on whether to allow, flag, or block an activity, moving beyond simple rule-based systems to adaptive fraud prevention.

Automated Sanctions & PEP Screening

Ambriel automates critical compliance workflows by screening users and transactions against a comprehensive database of over 100 global sanctions lists, Politically Exposed Persons (PEP) registers, and crime watchlists. This feature eliminates the need for slow, error-prone manual checks, ensuring organizations in regulated industries can meet Anti-Money Laundering (AML) and Know Your Customer (KYC) obligations without impeding growth or user onboarding speed.

Continuous Behavioral Monitoring & Alerts

The platform provides 24/7 surveillance of accounts and transactions, not just at the point of entry. By establishing a behavioral baseline for each user, Ambriel can detect anomalous patterns—such as sudden changes in login geography, unusual transaction sizes, or atypical account access times—and trigger immediate alerts. This continuous monitoring is essential for identifying account takeover attempts and long-term fraud schemes that evade initial checks.

Seamless, Customizable Onboarding Flows

Ambriel enables businesses to design friction-right onboarding journeys. Companies can integrate automated fraud and identity checks directly into their sign-up processes, customizing which verifications to run based on risk. This ensures that trusted customers experience a smooth path, while high-risk signups are subjected to additional scrutiny, effectively balancing security with user experience to reduce abandonment rates.

Use Cases of Ambriel

Onboarding & Synthetic Identity Fraud Prevention

During user registration, Ambriel detects and prevents fake accounts and sophisticated synthetic identity creation, which combines real and fabricated information to bypass traditional checks. By analyzing device signals, behavioral biometrics, and cross-referencing data points in real-time, it stops bot-driven signups and fraudulent identities before they can exploit platform resources or commit financial fraud.

Real-Time Payment & Transaction Fraud Mitigation

For every transaction, Ambriel monitors for anomalies that indicate payment fraud, such as stolen card use or fraudulent transfers. Its real-time scoring helps prevent chargebacks and unauthorized transactions by blocking high-risk payments instantly. This protection is vital for e-commerce and fintech platforms to reduce direct financial losses and associated processing fees.

Bonus, Promotion, and Referral Abuse Detection

Ambriel identifies and stops abuse of marketing incentives, a major concern for iGaming and retail sectors. It detects multi-accounting (where a single user creates multiple accounts to claim bonuses repeatedly), referral scams, and other forms of promotion exploitation. This ensures marketing budgets are spent effectively on genuine customer acquisition and loyalty.

Account Takeover (ATO) Protection

The platform safeguards user accounts from credential stuffing attacks and unauthorized access. By monitoring for unusual login behavior, new device registrations, and changes to account details from unrecognized locations, Ambriel can challenge or block suspicious login attempts, protecting both the end-user's assets and the platform's integrity from ATO-related fraud.

Frequently Asked Questions

What types of fraud can Ambriel detect?

Ambriel is designed to identify a wide spectrum of modern digital fraud. This includes synthetic identity creation, payment fraud and chargebacks, account takeover (ATO) attempts, multi-accounting and bonus abuse, referral fraud schemes, money muling, merchant abuse, and behaviors indicative of money laundering. Its system correlates signals across these vectors for comprehensive detection.

How does Ambriel ensure compliance with regulations like AML and KYC?

Ambriel ensures compliance through its automated Sanctions & PEP Screening feature, which checks against global regulatory databases, and its robust risk scoring that supports risk-based KYC approaches. The platform itself is built to adhere to key standards, being GDPR Ready, AML Compliant, and KYC Ready, providing the necessary tools and audit trails for regulated industries.

Can Ambriel integrate with our existing e-commerce or fintech stack?

Yes, Ambriel offers seamless integrations with popular platforms to simplify deployment. Based on the provided content, direct integrations include major e-commerce systems like Magento, WooCommerce, and Wix Commerce. The platform is built with API-first architecture, allowing for custom integration with virtually any proprietary or third-party fintech and business software stack.

Does Ambriel's fraud prevention create friction for legitimate customers?

A core design principle of Ambriel is to minimize friction for trusted users. Its AI-driven risk scoring and customizable workflows allow businesses to create a "friction-right" experience. Low-risk, legitimate customers undergo minimal checks for a smooth journey, while heightened security measures are only triggered for high-risk signals, effectively protecting revenue without damaging conversion rates.

You may also like:

Session Stacker

Session Stacker helps side hustlers stay focused by setting their next task before closing their laptop. Pick up exactly where you left off.

Vibrantsnap

Record your screen, get a polished product demo. AI auto-edits, adds voiceover & captions in minutes. Free for Mac & Windows.

ConvertBankToExcel

AI-powered bank statement converter. PDF to Excel, CSV, QBO & OFX in 30 seconds. 99%+ accuracy for accountants & bookkeepers.