finbots.ai

About finbots.ai

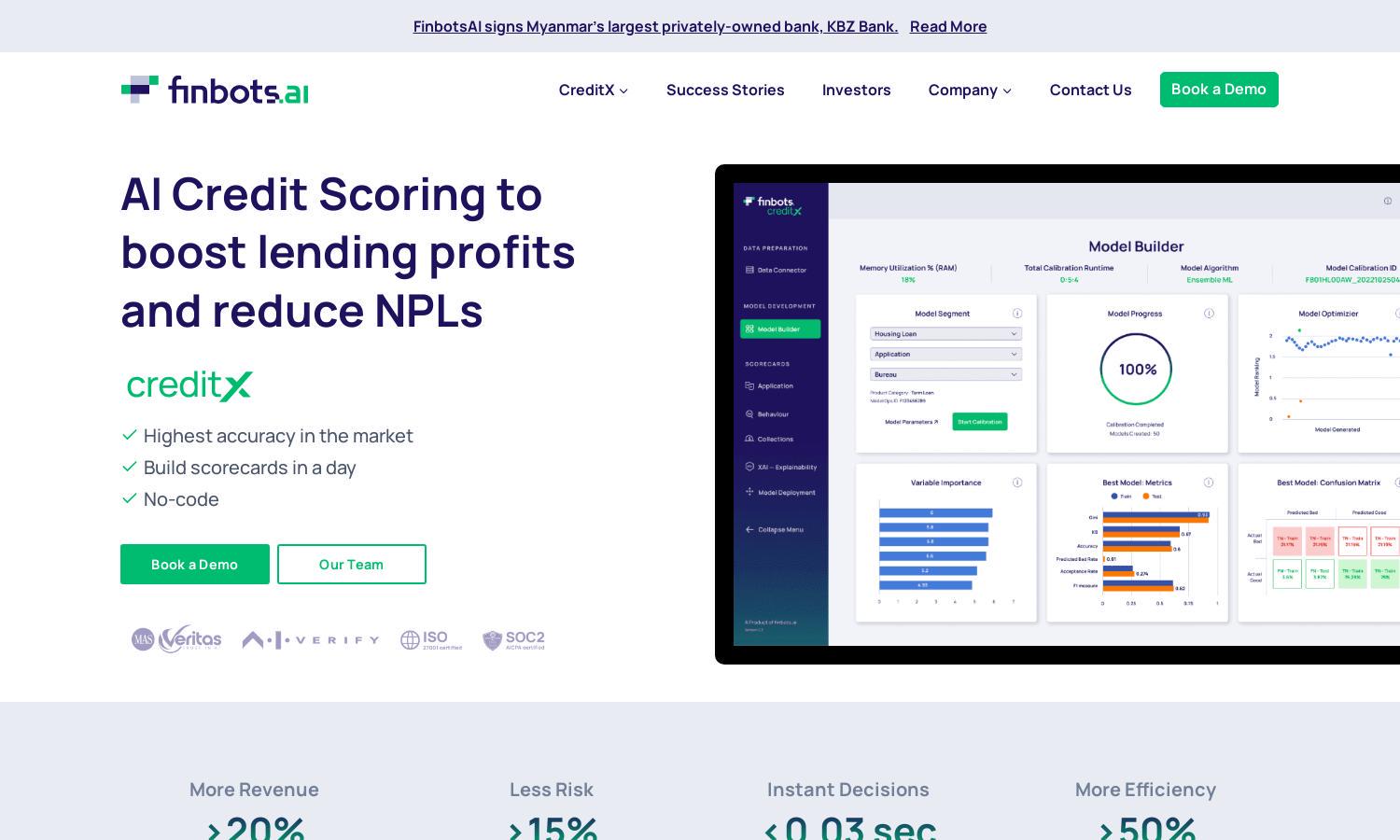

finbots.ai is an advanced AI credit risk platform aiming to revolutionize lending practices for financial institutions. Users can leverage its proprietary technology to create custom scorecards, ensure quick deployment, and make informed lending decisions. This platform minimizes risks and boosts approval rates, making it invaluable for lenders.

finbots.ai offers flexible pricing plans tailored to the needs of banks and lenders. Users can access custom features across different tiers, allowing them to choose a package that best fits their operational goals. Early adopters enjoy promotional discounts, enhancing the overall value of upgrading to more comprehensive plans.

finbots.ai features a user-friendly interface designed for seamless navigation, making it easy for users to build credit scorecards quickly. The intuitive layout ensures efficient access to essential functionalities, fostering a positive experience and enhancing user satisfaction through streamlined processes and interactive tools.

How finbots.ai works

Users begin their journey with finbots.ai by onboarding and integrating their data into the platform. They can quickly create custom scorecards using AI tools that validate and deploy their lending criteria. With real-time decisioning and one-click deployment, navigating the platform is efficient, allowing users to leverage powerful analytics to make informed decisions in seconds.

Key Features for finbots.ai

Custom Scorecards

With finbots.ai, users can create custom credit scorecards in just one day. This innovative feature allows financial institutions to tailor their lending criteria to specific market needs, increasing approval rates and reducing risks. The AI-driven technology assures accuracy and compliance for enhanced user experience.

Automated Data Validation

finbots.ai offers automated data validation, ensuring accuracy in credit scoring. This feature simplifies the data treatment process by transforming and standardizing inputs, which reduces bias and increases reliability. As a result, lenders gain confidence in their assessments and decisions, leading to effective risk management.

Instant Decisioning

Instant decisioning is a standout feature of finbots.ai, allowing lenders to rapidly process applications in under 0.03 seconds. This unique capability enhances operational efficiency, reduces wait times, and elevates customer satisfaction, positioning finbots.ai as a leading choice for modern lending solutions.

You may also like: